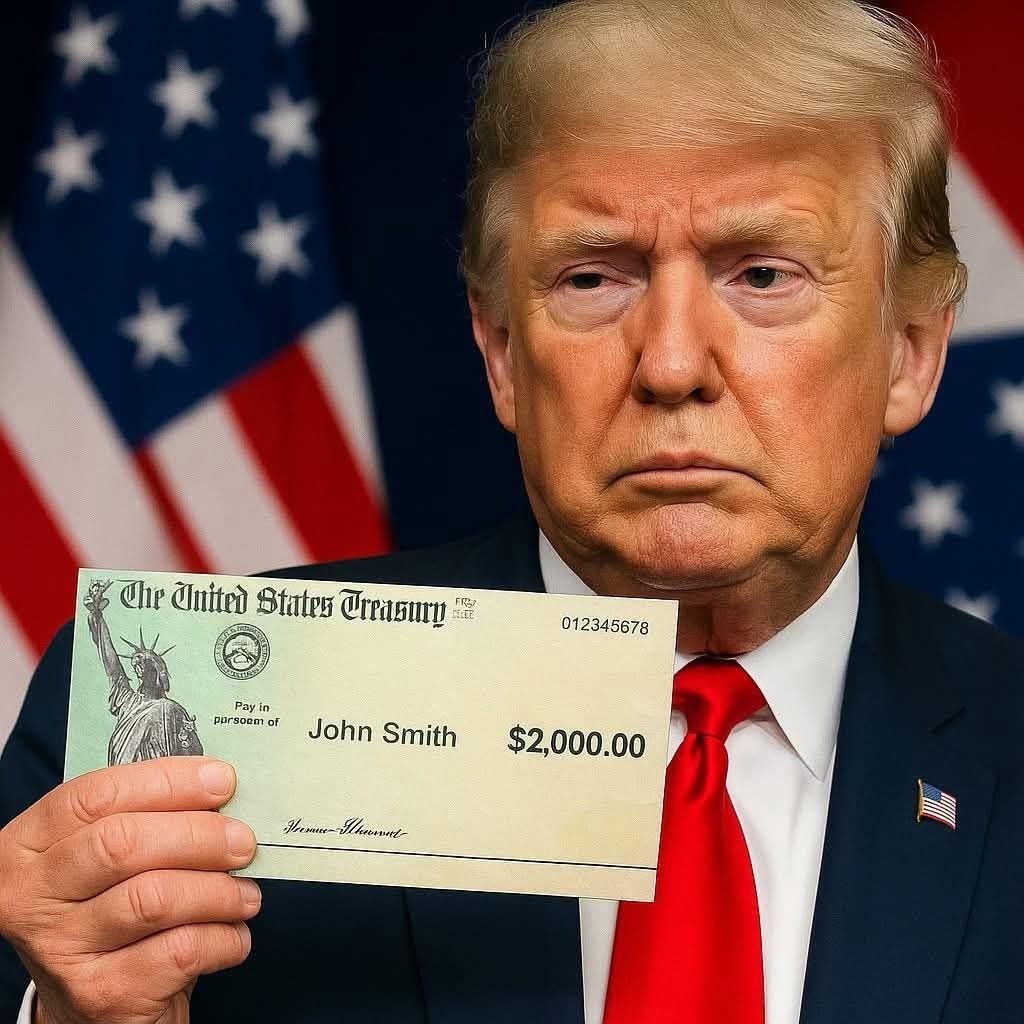

A recent proposal shared on Truth Social sparked widespread discussion across the country. It suggested the idea of providing a nationwide dividend of at least $2,000 per person, funded through tariff revenue. The message described it as a straightforward plan: collect money from tariffs on imported goods and distribute a portion of that revenue directly to households, with high-income earners excluded. No detailed system or timeline was attached, and the announcement came as a broad concept rather than a finalized policy.

The idea immediately drew attention because it touches on something many Americans feel strongly about: taxes, personal finances, and how the government manages revenue. The proposed approach suggests shifting more of the financial burden toward foreign companies that sell goods in the United States, while offering direct benefits to residents in return. Supporters of the concept view it as a way to relieve pressure on everyday taxpayers, while critics question how such a system would function sustainably.

Economists quickly began comparing the concept to the Alaska Permanent Fund, which pays residents a yearly amount based on revenue from state-controlled natural resources. However, Alaska’s system works because it relies on a large, stable source of income. Replicating that model on a national scale using tariffs would require a significant increase in tariff revenue, far beyond what the government currently collects. Any shift of that size would influence import levels, pricing, supply chains, and trade relationships, creating effects that would ripple throughout the economy.

Continue reading on the next page…